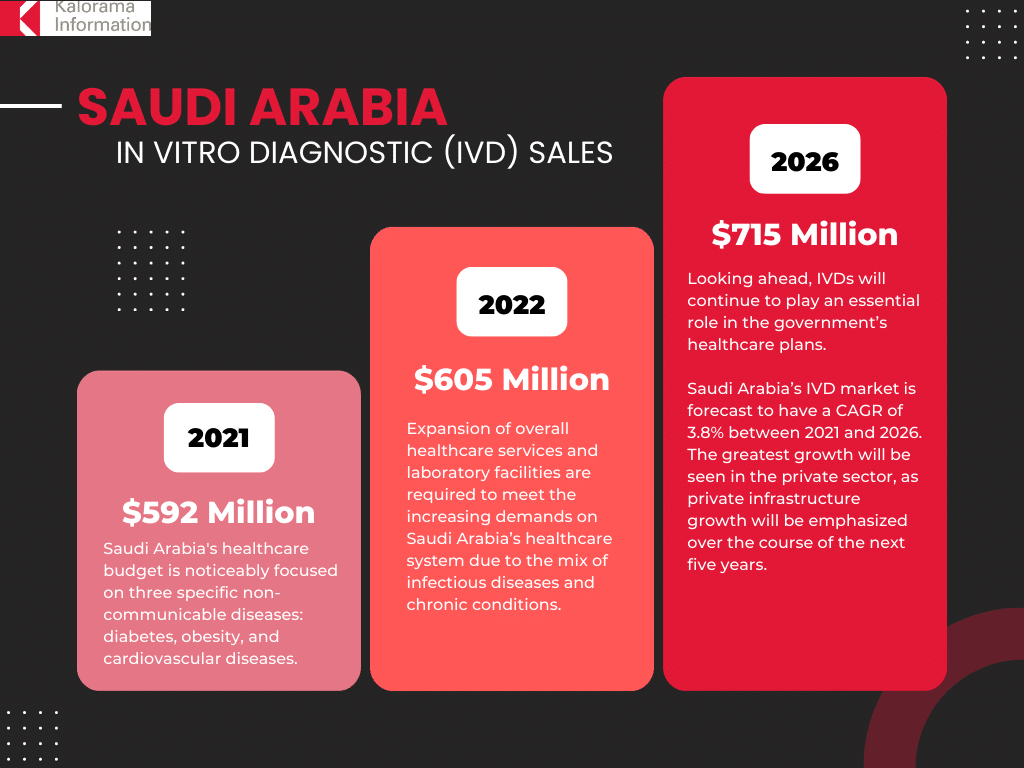

The market for in vitro diagnostics (IVDs) in Saudi Arabia, a young country in an aging world, reached an estimated $605 million in 2022, according to Kalorama Information’s 30-Country IVD Market Atlas. In 2022, the market was driven in part by COVID-19 testing, with about 44 million PCR COVID-19 tests performed through last August.

Looking ahead, IVDs will play an essential role in the Saudi Arabian government’s healthcare plans. Saudi Arabia’s IVD market is forecast to have a CAGR of 3.8% between 2021 and 2026. The greatest growth will be seen in the private sector, as private infrastructure growth will be emphasized over the course of the next five years.

In Saudi Arabia, the IVD market is largely made up of imports as domestic manufacturing of diagnostic tests is nearly nonexistent, according to Kalorama.

Aging populations typically require greater medical care and shape international healthcare markets, including in vitro diagnostics. Although Saudi Arabia is home to more than 35 million people, only 3% are 65 years or older. And while IVDs currently play an essential role in the government’s healthcare plans, there is room for expansion. Only 1.5% of the overall healthcare expenditure is spent on IVDs, lower than the global average of 2%.

Nonetheless, Saudi Arabia boasts one of the largest healthcare markets in the Middle East and is an attractive target for investors, manufacturers, and distributors. Health and living standards are high; about 85% of the population has access to medical providers, and all residents are covered for basic and essential healthcare services through national health insurance coordinated by the Ministry of Health (MOH).

The country has a comprehensive medical device regulatory policy to improve the safety and effectiveness of medical and IVD devices, while providing Saudi Arabians with improved access to such products.

According to Kalorama, overall healthcare services and laboratory facilities will need to expand to meet increasing demands imparted by a mix of infectious diseases and chronic conditions. The prevalence of diabetes, now 24%, is expected to continue to increase, and other lifestyle-related diseases such as cardiovascular conditions are expected to grow and put pressure on the healthcare infrastructure.

In an unusual outcome for national health systems, publicly funded hospitals in Saudi Arabia are perceived to have higher-quality healthcare than private-sector hospitals. The MOH and other government-affiliated hospitals make up 77% of the country’s available healthcare infrastructure, while private healthcare makes up the rest. Nonetheless, private facilities serve 65% of the population, including expatriates (30%) and private-sector employees (35%) and their families, who do not have access to public institutions.